The Grocery Shakeout Has Begun, and Groceryshop 2025 Made It Clear

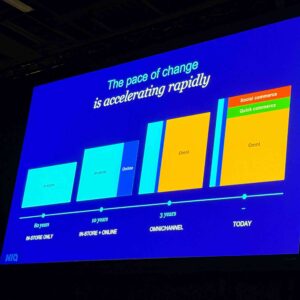

Grocery is in the middle of a structural reset, and the implications for manufacturers are unambiguous. E-commerce, retail media, social platforms, and AI agents are reshaping how food is sold and bought—redefining the role of physical stores in the process. The impact is clear: subscale retailers will struggle, economics will consolidate, and the map of distribution and influence will look very different within this decade.

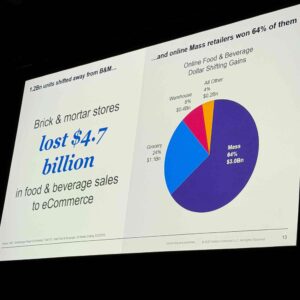

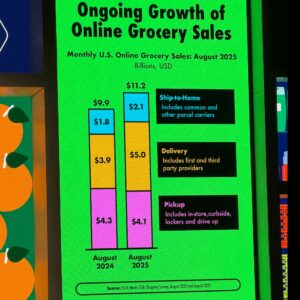

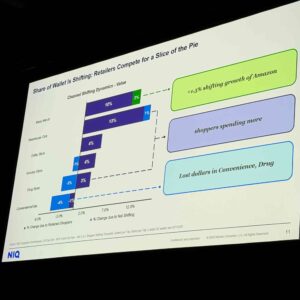

Ecommerce Is Winning (and Price Is Algorithmic)

Online is the growth engine and the mass channel is setting the pace. Walmart and Amazon are widening their advantage through speed and coverage, while last-mile platforms condition shoppers to equate the deliverer with the retailer. Meanwhile, price comparison basket apps assemble a cart, swap in private label equivalents, and route the order to the cheapest total. At scale, this becomes a race to the bottom for undifferentiated items, and a structural advantage for anyone who can deliver faster at lower cost. The operating rule is simple: scale wins profit.

Manufacturer moves: ensure product content and availability are flawless in the channels that deliver quickly; build KVI-resilient packs; and pressure test unit economics in delivery-heavy mixes. Treat last-mile platforms as front doors, not back doors, and plan promotion and sampling where the orders actually flow.

Retail Media Networks Are Entering the Fallout Stage

Retail media spend is concentrating in two places: Amazon and Walmart. The long tail lacks traffic, targeting, and reporting rigor, which means manufacturers cannot prove incrementality at scale. As a result, many RMNs will not clear budget hurdles and will wind down. Without retail media and marketplace profits to subsidize fulfillment, subscale ecommerce turns margin negative for those retailers. Expect a flight to quality in media plans: fewer networks, tighter tests, and clearer ROI.

Manufacturer moves: concentrate spend where incrementality is consistently measurable; set hard guardrails for MMM and holdouts; redeploy underperforming RMN budgets into social commerce and creator programs with clean data ingestion.

Social Commerce Is Where Discovery Happens

TikTok and Reddit are where consumers learn about products, ingredients, and health trends. TikTok Shop keeps pushing toward in-app checkout; Reddit communities drive deep product research and trusted word-of-mouth. For manufacturers, the appeal is twofold: attention and measurement. Both platforms are investing in brand safety, transparency, and reporting pipelines that plug directly into analytics stacks, which many RMNs still struggle to match.

Manufacturer moves: build ads specifically for TikTok and Reddit instead of reusing assets like TV cutdowns. Stand up rapid test cells with clear lift metrics. Treat social discovery as the top of a deterministic funnel that ends on a product detail page optimized for both humans and machines.

AI Agents Are Becoming Shoppers

Chat-based shopping just crossed the line from recommendation to transaction. ChatGPT could already help consumers compare products and complete a purchase, and now agent features are evolving toward orchestrating the entire trip. Pair that with retailer assistants like Walmart’s Sparky and you can see the outline: agents draft the basket, select the retailer, and execute the order. The lower funnel collapses. In that world, the advantages shift to structured product data, accurate availability, pricing discipline, and fulfillment performance.

Manufacturer moves: make your pages machine readable; normalize attributes, claims, and FAQs; instrument availability and price integrity; and plan for agent-triggered promotions that don’t depend on human persuasion. On the demand side, expect AI-generated creator content to seed interest on TikTok and Reddit—then let agents close the loop.

What Physical Grocery Becomes

Two viable roles remain for stores:

- Experience and inspiration. Food halls, live demos, culinary education, and curated new idea sets that make a trip feel worth it.

- Efficient fulfillment nodes. Smaller footprints focused on fast pick/pack and low cost per order.

Manufacturers should plan assortments and activations for both: experiential exclusives with chains like HEB and Wegmans, and frictionless, high-velocity core items for mass ecommerce and delivery platforms. Recognize that “personalization” often reads as “exclusivity” to consumers. Design special access moments, not just targeted coupons.

The Manufacturer Playbook (Next 90 Days)

- Refocus Media. Shift spend toward Amazon and Walmart where incrementality is provable; move the next tranche to TikTok/Reddit with lift tests and clean data contracts.

- Agent Readiness. Audit PDP structure, attributes, and schema; close gaps that prevent agents from ranking your SKUs.

- Speed as Strategy. Prioritize channels promising faster delivery; align supply to service the fastest nodes.

- Private Label Defense. Win on distinctiveness—functional superiority, proof-based claims, and exclusive formats with experiential grocers.

- SNAP and Mix. Scenario plan for state-level SNAP restrictions; adapt pack price architecture and promotional plans accordingly.

- Innovation Cadence. Replace stage-gate with weekly test-learn sprints; build the capability to stand up and tear down variants in days.

Drive Wheel’s Role

Our peer groups and research help operators pick a lane, build the operating model for that lane, and pressure test the unit economics under real–world constraints. If you want to put this playbook to work with manufacturing peers facing the same decisions, we’ll get you in the room where the hard questions are answered.

Engaging Discussions Enable Confident Decisions®

When you’re busy with the daily demands of your job, it’s easy to overlook the opportunities that will drive long-term growth. When you become a member of a Drive Wheel peer group, you can identify new strategies, reduce risk, and make confident decisions that will grow your business faster and more strategically.

We host two-day in-person meetings twice a year where leaders discuss their new strategies, innovation plans, and business challenges to get feedback from their peers. Members leave the meeting knowing they have thought about their idea from every angle. Between meetings, we conduct benchmarking studies and weekly news roundups to keep our members informed about changes in the industry.