Innovation vs. Complexity: What the FMI Supply Chain Forum Made Clear

Innovation is driving offense. Complexity is putting teams on defense. That was my headline leaving St. Louis, and the tension ran through nearly every conversation and chart. Manufacturers are chasing growth with newness, while service, inventory, and forecast discipline are buckling under SKU sprawl and co-manufacturing layers.

The opportunity feels obvious: get sharp on the total cost of innovation, and pair it with a pragmatic, data-forward planning model that protects availability and margin.

The Growth Play (And The Friction It Creates)

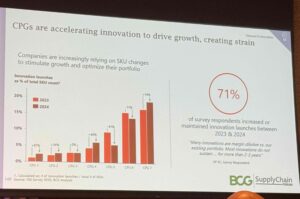

Manufacturers leaned hard into launches again—with 71% of leaders saying they increased or maintained innovation year over year—and while new SKUs added dollars, units didn’t pop the way teams hoped. Meanwhile, case fill rates slipped from pre-Covid levels, on-shelf availability targets remain elusive, and days of supply are materially higher than 2018. Retail partners are also consolidating space, expanding tiered private label, and forcing tougher choices on what earns the shelf.

All those symptoms tie back to one word: variability.

- Shorter development lead times

- Poor forecast accuracy

- Misaligned timing with suppliers and retailers

- Promo events, changeovers, co-man handoffs

Together they create a volatility amplifier, and it shows up in the P&L and balance sheet:

- Every +8 days of finished goods ties up ~1% of net revenue in working capital

- Every +2% sustained availability can add ~1% to revenue—if you can hold it

Co-manufacturing: Speed Today, Service Penalties Tomorrow

Co-mans are doing exactly what they are meant to do—accelerate speed to market and flex capacity for new formats. But as their share of volume rises, so does service dispersion. More nodes, more handoffs, more schedule conflicts.

Best-in-class teams are closing the gap with:

- Better demand sensing

- Tighter slotting

- Clearer guardrails on what gets outsourced

Tariffs, CapEx, And The AI Drumbeat

Teams are stockpiling ahead of tariff deadlines, renegotiating supplier terms, and redrawing networks—moves that distort the demand signal and make coordinated planning even harder. Yet capital is still flowing. The largest CPGs have nudged CapEx as a percent of revenue higher since 2019, with familiar bets on robotics, AI/ML, predictive analytics, GenAI, and autonomous movement. Layer on cybersecurity and inflation risk, and the backdrop only adds to the volatility.

A Practical Playbook: Scale What Wins & Prune The Dogs

The takeaway is clear: innovation without discipline just creates volatility. Complexity will keep putting teams on defense, so here’s five ways to run better plays.

1) Run a “Total Cost of Innovation” audit before the sell-in. Model gross margin after service drag. Treat changeovers, co-man premiums, MOQ waste, expedited freight, penalties, and incremental inventory as line items—because they are. Score concepts on incremental contribution net of those headwinds, not just on topline potential. If a launch can’t clear the bar with today’s network reality, it doesn’t launch.

2) Set explicit service guardrails with retail partners. Co-design targets by segment—core, seasonal, test—and tie promo eligibility to forecast confidence and available capacity. Where space is tightening, trade width for depth on proven winners and pilot newness in smaller, data-rich sets with clear exit ramps.

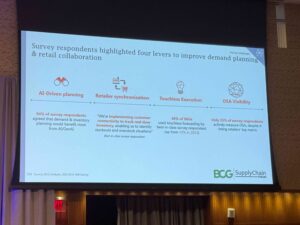

3) Upgrade planning from hindsight to demand sensing. Shift toward AI-enabled forecasting that ingests leading indicators—retailer POS, digital traffic, price gaps, media pulses, and weather. Leaders are using “touchless” forecasting on a meaningful slice of SKUs and pairing it with automated inventory and production planning to cut manual rework. While it’s early and data hygiene still determines the ceiling, the direction is right.

4) Rationalize the long tail—then hold the line. If a SKU can’t carry its weight on availability and velocity, retire it and concentrate resources where the flywheel spins: fewer changeovers, tighter cycles, better CFR, and more predictable promotional execution. Use an “add-one, cut-one” policy for crowded sub-categories to prevent SKU creep.

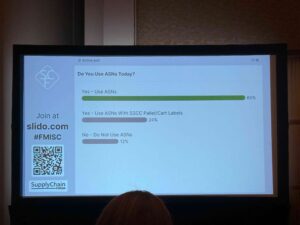

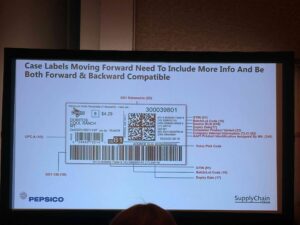

5) Get honest about co-man economics. Not all external capacity is equal. Build a simple scorecard: service performance, changeover responsiveness, tech connectivity (schedule visibility, ASN accuracy), and true landed cost. Where volatility is chronic, either insource, dual-source, or adjust innovation ambition in that format.

What This Means For Growth Team

In a soft unit environment—pressured by tariffs, shifting demographics, and health interventions—innovation still matters. It keeps categories fresh, repositions brands, and earns secondary placement. But innovation that degrades service is a sugar high. The better bet: a tighter loop between commercial agenda and operations, with portfolio choices shaped by realistic capacity and capacity plans shaped by where the brand can actually win.

At Drive Wheel, our north star is simple: Engaging Discussions Enable Confident Decisions. This is exactly the kind of topic we put on the table—pressure-testing scorecards, comparing demand-sensing pilots, and trading operator lessons on co-man structures that work. If your team is wrestling with SKU governance, AI planning, or retailer guardrails, bring it to your peer group—we’ll make it actionable.

My aim with pieces like this is to be clear, candid, and useful—no hype, just patterns we can act on together. If you’d like a working session on a total-cost-of-innovation model, or a template to score upcoming launches & align with your retailers, let’s set it up.

Engaging Discussions Enable Confident Decisions®

When you’re busy with the daily demands of your job, it’s easy to overlook the opportunities that will drive long-term growth. When you become a member of a Drive Wheel peer group, you can identify new strategies, reduce risk, and make confident decisions that will grow your business faster and more strategically.

We host two-day in-person meetings twice a year where leaders discuss their new strategies, innovation plans, and business challenges to get feedback from their peers. Members leave the meeting knowing they have thought about their idea from every angle. Between meetings, we conduct benchmarking studies and weekly news roundups to keep our members informed about changes in the industry.